The German election has produced a victory for right-wing German Chancellor Mrs Angela Merkel, the best result for her party since 1990. However, the existing coalition of Merkel’s Christian Democrat Union (CDU), the Bavarian Christian Social Union (CSU) and the small Free Democrats (FDP) cannot continue because the FDP failed to make the 5% voting share threshold to enter the German parliament (Bundestag). The FDP vote is hugely down from 14.6% in 2009. Most of those lost votes went to the CDU. So even though Merkel’s CDU-CSU bloc has polled the most at about 42.5%, up from 34% in 2009, it will have to try to form a grand coalition with the opposition Social Democrats (SPD), which polled 26%, up a bit from the all-time post-war low of 23% that the SPD got in 2009. The Greens polled badly at 8% (down from 10.7% in 2009) and were passed by the Left Bloc (die Linke) which polled 8.5%. So, although old coalition polled 47% (compared to 48% in 2009) over the ‘left’ (SPD, Greens and die Linke) with 43% (down from 46% in 2009), Mrs Merkel must find new coalition partners.

Germany is the largest and most important capitalist economy in Europe, if not yet the most important European imperialist power (there it vies with the UK and France). It is the main creditor and funder of the Eurozone member states. So what does this election campaign and result tell us about the future of German capitalism and the strategy being adopted by its political leaders?

On the surface, all looks good for the economic health of Germany as there appears to be very little difference on policy between the CDU and the SPD. You would find it hard to push a sheet of paper between them on major policy issues for Germany. So it seems likely that a Grand Coalition between the CDU-CSU and SPD will be formed with two-thirds of the seats in parliament and German capitalism looks set fair for the status quo for another four years.

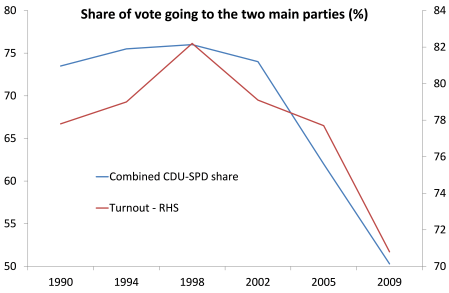

However that is too simple a calculation. There are new economic and political pressures for German capitalism that will make it more unstable than before. The first thing is that there has been a long-term trend in German (and other Euro) politics: namely, the fragmentation of electoral votes from two or three parties into several. That’s a recipe for instability and paralysis, as we have seen in Greece, Italy, Belgium, the Netherlands etc. This election has slightly reversed that trend with the two main parties polling about 56% compared to 50% last time, but that is no better than in 2005. Some 16% of votes will not be represented in parliament due to the 5% hurdle — more than ever before. The turnout may be slightly better than in the recession year 2009 at 73%, but it’s well down from the 1990s.

And then there is the joker in the pack: the eurosceptic Alternative fur Deutschland party (AfD), a party made up of academics and other petty-bourgeois elements, strongly opposed to ‘handouts’ to the ‘free-spending’ peripheral Euro states and demanding a return to the D-mark. The AfD polled 4.9%, just not quite enough to gain representation. But by polling close to the 5% threshold, that will stir up new currents beneath the surface of serenity in German politics, especially leading up to the Euro elections next May.

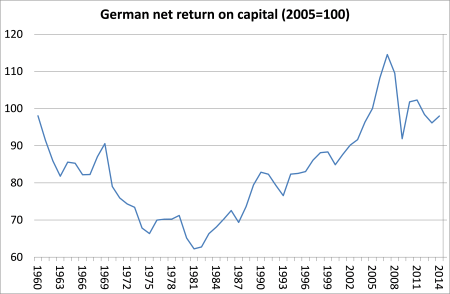

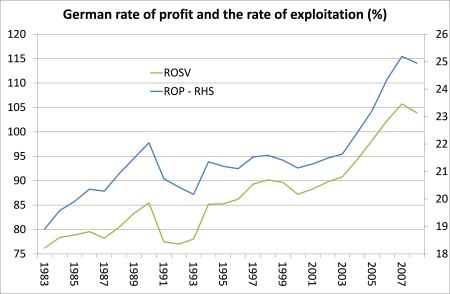

Despite the Euro debt crisis and the ‘contingent’ costs to the pockets of the German taxpayers from the bailout payments to the distressed Eurozone states, the German ruling class is still convinced that the euro is worth having over the D-mark. That is because German capitalism has gained most from the trade and capital integration of the single currency. The best indicator of that is to look at what has happened to German capital’s rate of profit. The European Commission AMECO database provides a measure of the net return on capital invested for many countries including Germany. There are several technical issues with this measure, but I think it gives a relatively good guide to trends (partly because it is supported by alternative data from the Extended Penn World Tables that I have used before to measure country rates of profit).

The AMECO measure shows that Germany’s rate of profit fell consistently from the early 1960s to the early 1980s slump (down 30%) – much like the rest of the major capitalist economies in that period. Then there was a recovery (some 33% up – using Penn measures) with a short fall during the recession of the early 1990s and then stagnation during the 1990s as West Germany digested the integration of East Germany into its capitalist economy. The real take-off in German profitability began with the formation of the Eurozone in 1999, generating two-thirds of all the rise from the early 1980s to 2007.

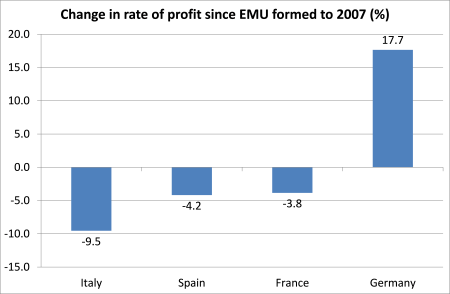

German capitalism benefited hugely from expanding into the Eurozone with goods exports and capital investment until the Great Recession hit in 2008, while other Euro partners lost ground.

Once the east was integrated, Germany’s manufacturing export base grew just as much as the new force in world manufacturing, China, did.

But the fall in profitability during the Great Recession was considerable and AMECO forecasts do not suggest a significant recovery in profitability since. Indeed profitability will be below the level of 2005 from now on. So things may be more difficult from hereon.

It is interesting to consider the reason for the rise in the German rate of profit using Marxist categories. The rise in the rate of profit from the early 1980s to 2007 can be broken down into a rise in the rate of surplus value of 38%, but only a small rise of 5% in the organic composition of capital. This is consistent with Marx’s law of profitability in that the rate of profit rises when the increase in the rate of surplus value outstrips the increase in the organic composition of capital. It seems that the ability to extract more surplus value out of the German working class while keeping the cost of constant capital from rising much was the story of German capitalism. In other words, constant capital did not rise due to innovations and investment in new technology while surplus value did, due to the expansion of the workforce using imported labour from Turkey and elsewhere at first – and then expansion directly into Europe later.

The real jump in the rate of profit began with the start of the Eurozone. In this period, the organic composition of capital was flat while the rate of surplus value rose 17%. German capital was able to exploit cheap labour within EMU but also in Eastern Europe to keep costs down. The export of plant and capital to Spain, Poland, Italy, Greece, Hungary etc (without obstacle and in one currency) allowed German industry to dominate Europe and even parts of the rest of the world.

Most important, the fear of the export of jobs to other parts of Europe enabled German capitalists to impose significant curbs on the ability of German labour to raise their wages and conditions. The large rise in the German rate of profit was accompanied by a sharp increase in the rate of surplus value or exploitation, particularly from 2003 onwards.

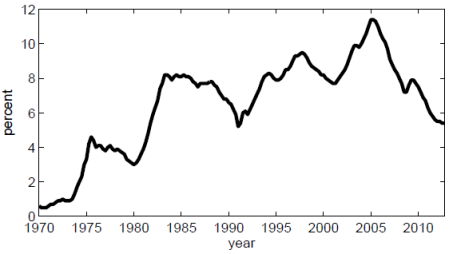

What happened from 2003 to enable German capitalism to exploit its workers so much more? In 2003-2005 the SPD-led government implemented a number of wide-ranging labour market ‘reforms’, the so-called Hartz reforms. The first three parts of the reform package, Hartz I-III, were mainly concerned with creating new types of employment opportunities (Hartz I), introducing additional wage subsidies (Hartz II), and restructuring the Federal Employment Agency (Hartz III). The final part, Hartz IV, was implemented in 2005 and resulted in a significant cut in the unemployment benefits for the long-term unemployed. Between 2005 and 2008 the unemployment rate fell from almost 11% to 7.5%, barely increased during the Great Recession and then continued its downward trend reaching 5.5% at the end of 2012, although it is still higher than in the golden age of expansion in the 1960s.

German unemployment rate (%)

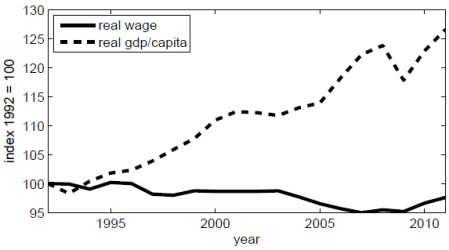

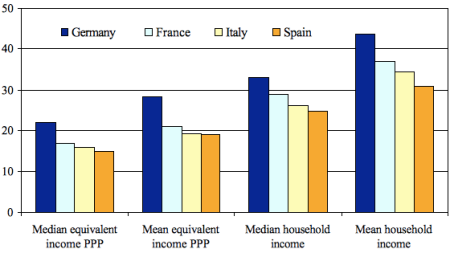

A wonderful success then? Not for labour. About one quarter of the German workforce now receive a “low income” wage, using a common definition of one that is less than two-thirds of the median, which is a higher proportion than all 17 European countries, except Lithuania. A recent Institute for Employment Research (IAB) study found wage inequality in Germany has increased since the 1990s, particularly at the bottom end of the income spectrum. The number of temporary workers in Germany has almost trebled over the past 10 years to about 822,000, according to the Federal Employment Agency. This is something we have seen across Europe – the dual labour system in Spain being the prime example.

So the reduced share of unemployed in the German workforce was achieved at the expense of the real incomes of those in work. Fear of low benefits if you became unemployed, along with the threat of moving businesses abroad into the rest of the Eurozone or Eastern Europe, combined to force German workers to accept very low wage increases while German capitalists reaped big profit expansion. German real wages fell during the Eurozone era and are now below the level of 1999, while German real GDP per capita has risen nearly 30%.

No wonder German capitalism has been so ‘competitive’ in European and world markets. The Hartz reforms may be regarded as a success by German capital and mainstream economists. But they have always been very unpopular among the German public. In this election, no major party has dared to run on a platform that openly endorses the Hartz reforms. Indeed, several parties tried to win votes by promising to roll back the Hartz reforms, including the SPD which initiated the reforms in 2003-2005 under Chancellor Gerhard Schroeder.

Of course, this is not to deny that the German working class is better off than its peers in the rest of the Eurozone and this explains why German voters who have voted, did so, by and large, for parties that wish to preserve the status quo.

The German ruling class and the leadership of the two main parties are generally agreed that the Eurozone must be kept intact as it is, despite the cost of the debt crises in the peripheral EMU states. After all, German capitalism has gained hugely from the Eurozone, as I have shown. Greece should not probably have been allowed in, as Merkel and others have said on several occasions, but now it is in, it is too risky to kick Greece out as it sets a dangerous precedent. And the cost of yet another Greek bailout in the next year is small.

But there are are some differences between the CDU and the SPD over the Eurozone. The CDU does not want any integration of debt and debt payments within the Eurozone through things like a euro redemption fund or Eurozone bonds, while the SPD does. The CDU does not want German capital taking on any contingent liability of the future or existing debt of the likes of Italy or Spain, even if it never happens that they cannot service it. Even so, a Grand Coalition will agree eventually to ease the terms of repayment of the bailout recipients – indeed it will probably put repayment back for likes of Greece to the indefinite future. Remember that the US allowed the UK to repay what they owed the US after the second world war for ages – it was only fully paid off in 2005!

However, the Grand Coalition will be set with difficulties from its beginning. It will be under the pressure from the right, the eurosceptics and the small business FDP to refuse any further bailouts and apply severe austerity to the peripheral EMU states and France. The SPD will be under pressure from the left to break with the coalition to reverse the Hartz reforms, spend more and avoid nuclear energy or leave the coalition.

German capitalism may have been a ‘success story’ over the last 25 years since the integration of East Germany. But its long-term prospects do not look so good from here. It has a declining and ageing workforce (this will be the last election in which the majority of voters were under the age of 55) and less areas for exploitation of new labour outside Germany, while competition from the likes of China and Asia will mount. And the costs of maintaining the Eurozone will grow. All these are issues for the strategists of German capital now that there will be a new coalition in power.

The German electorate may have voted for the status quo again in this election, but the relatively low turnout and the low share of the vote for the main parties show that there is growing disillusionment with the ‘success’ of German capitalism that has given just a few crumbs for the working class off the table of bounty for German capital income. And the burden on the working class in paying for the further ambitions of German capitalism is set to rise.